We are going to learn how to create a Tax Invoice in Sage Pastel Partner.

We have included a video lesson as well as screenshots with instructions below the video.

Video

To clearly see the details on the Pastel Partner screen it is advisable to watch the video below in full screen mode. To do so, click on the full screen icon in the lower right of the video player i.e. the one next to the letters “HD”.

Get Free Sample Pastel Lessons

See how easy it is to learn Sage Pastel Partner by getting some free sample lessons to start with

Screenshots with Instructions

You can click on the screenshots below to view them in full screen mode. This will allow you to see the details of the Sage Pastel Partner Screen more clearly.

When you click on a screenshot it will open a new tab in your browser. Once you have viewed it please close the tab to get back to this page.

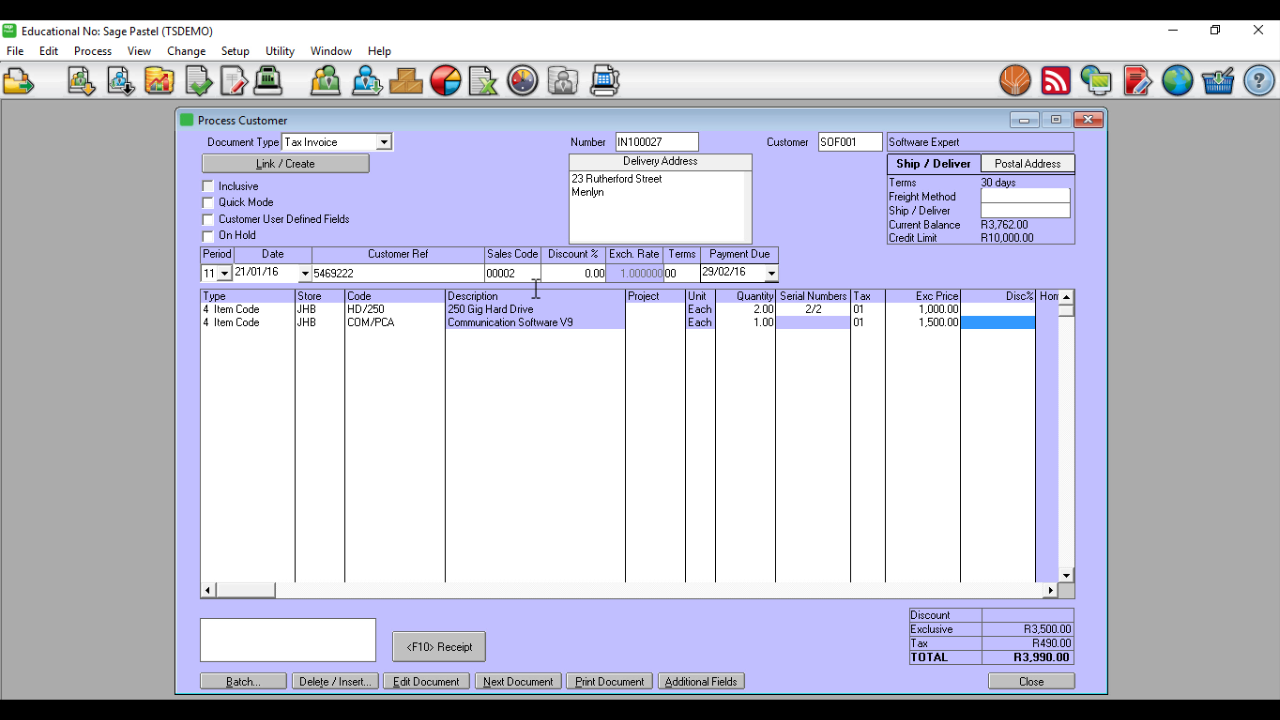

Using the demo company, we will be invoicing the customer “Software Expert” for the following items:

- 250 Gig Hard Drive (the customer purchased 2 of these). Selling price of R1000 excl. VAT each.

- Communication Software V9 (the customer purchased 1 of these). Selling price of R1500 excl. VAT each.

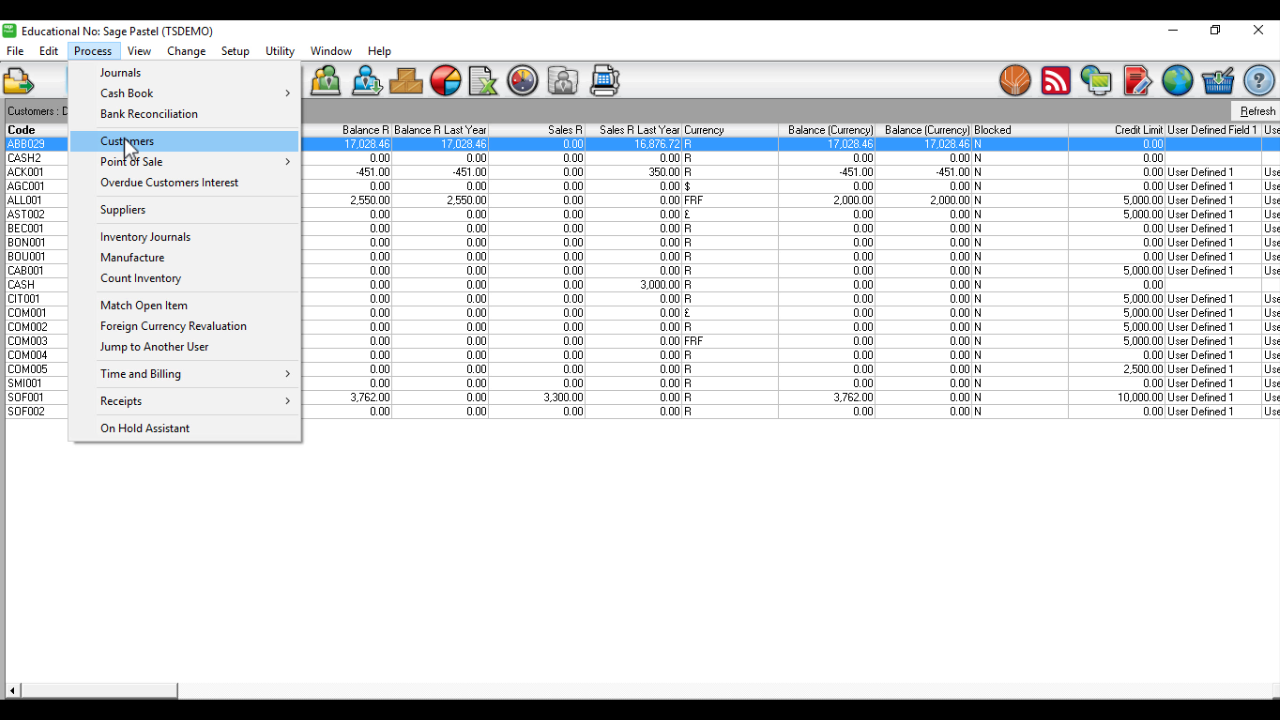

To start the process select Process…Customers from the menu bar.

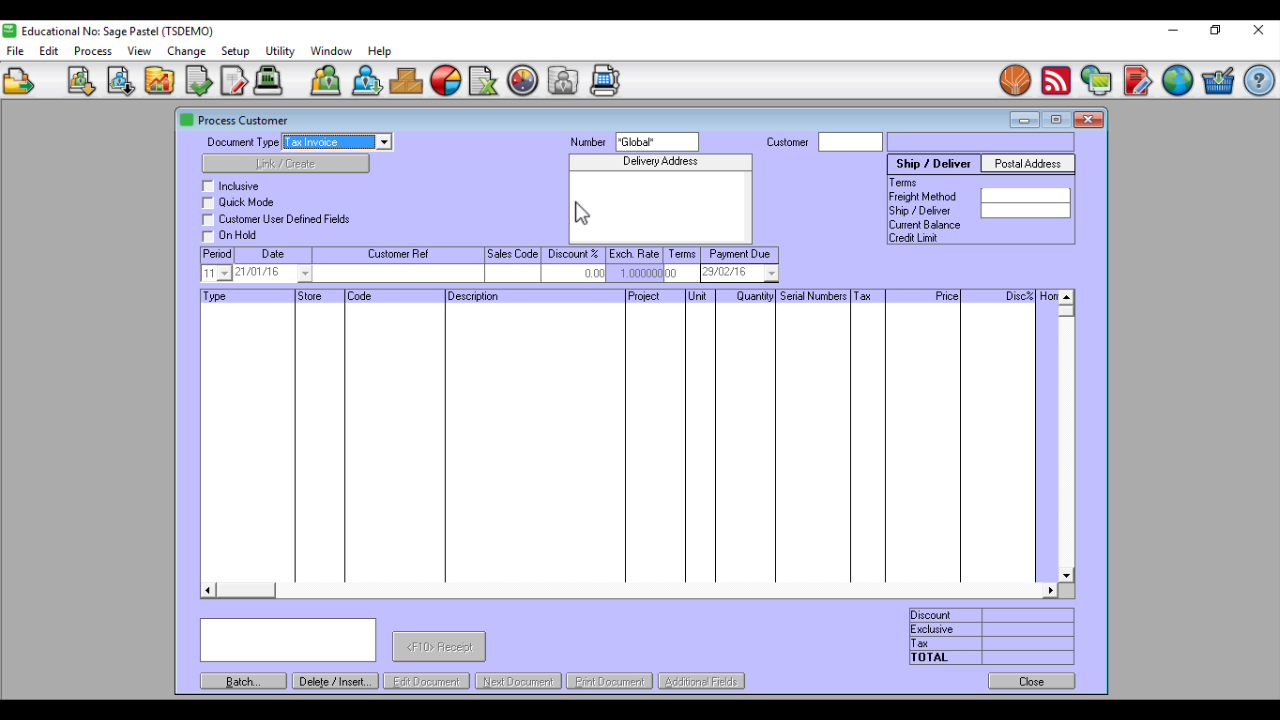

This will bring up the following screen.

In the Document Type Field make sure that Tax Invoice is selected from the drop down list.

Tab until you get to the Customer Field and click on the Zoom Button (which is the magnifying glass icon)

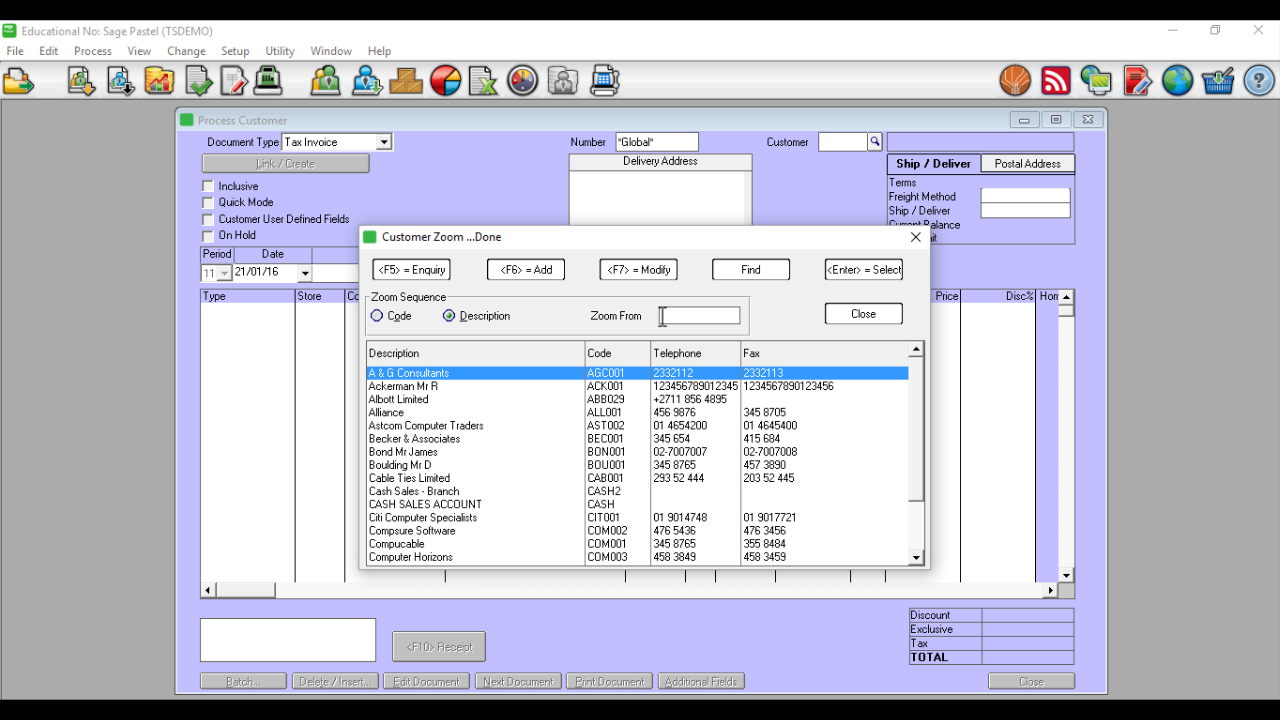

Then select “Software Expert” from the list of customers that come up on the Customer Zoom screen and press the Enter key on your keyboard or click on the =Select button.

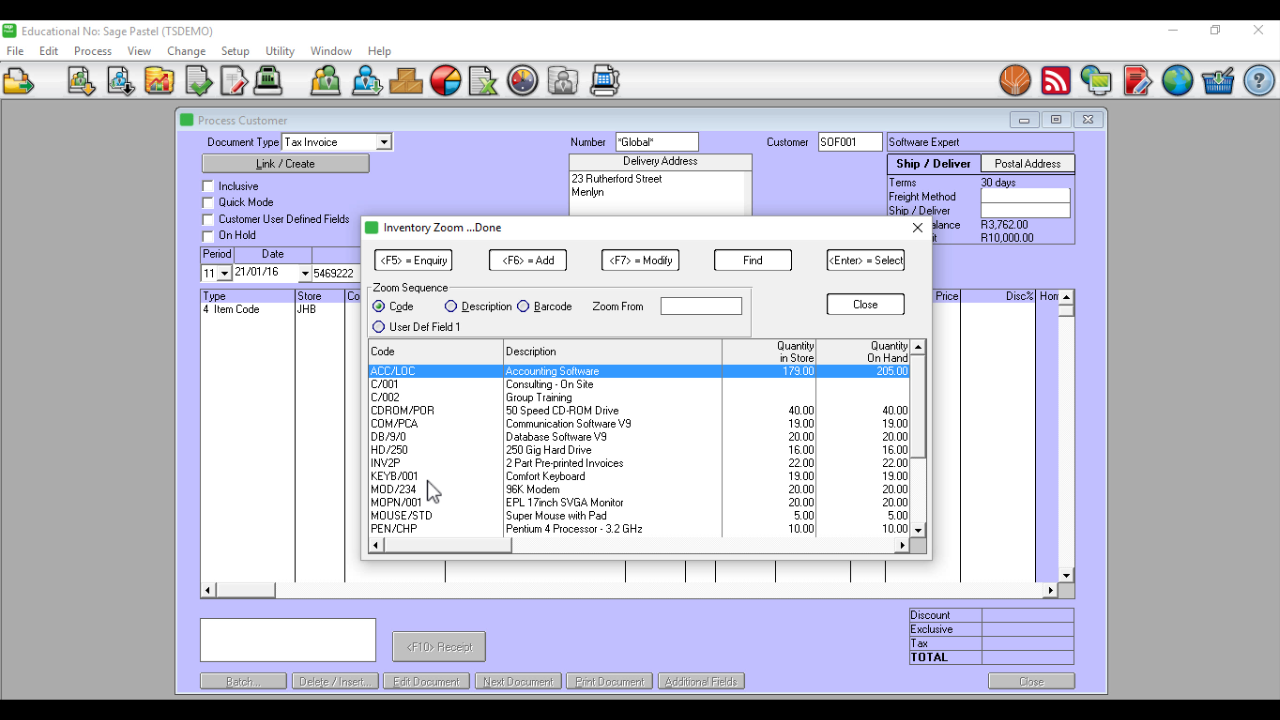

This will now populate the fields such as the Delivery Address with the selected customers details.

Press Tab until you get to the Date field and confirm the date.

Tab to the Customer Ref and enter the reference number that the customer provided for this order.

Continue to press the Tab key until you come to the Code Column.

Click on the Zoom button and select the item HD/250 250 Gig Hard Drive and then click on the = Select button.

You will be back on the Tax invoice screen. Tab to the Quantity column and enter 2 which is the quantity sold of this item.

As this inventory code has serial numbers Pastel will prompt you to select the serial numbers of the specific items which were sold. Items such as hard drives will have their specific serial numbers stored in the system when they are initially purchased. A typical reason for this is for warranty purposes. If the customer brings the item back because it is defective the company will be able to confirm that it is the exact Hard Drive that was sold to that customer as the serial number was recorded when the item was sold.

Continue to Tab until you reach the next line.

IMPORTANT: If you want to save a line that you have entered you must tab to a new line before it will be saved. If you don’t tab to a new line then the line will not be saved.

You can now enter the details of the next item which was sold. i.e. the Communication Software V9.

Enter the details of this item.

Note that the Total of the invoice on the bottom right automatically updates as you change quantities and add new items.

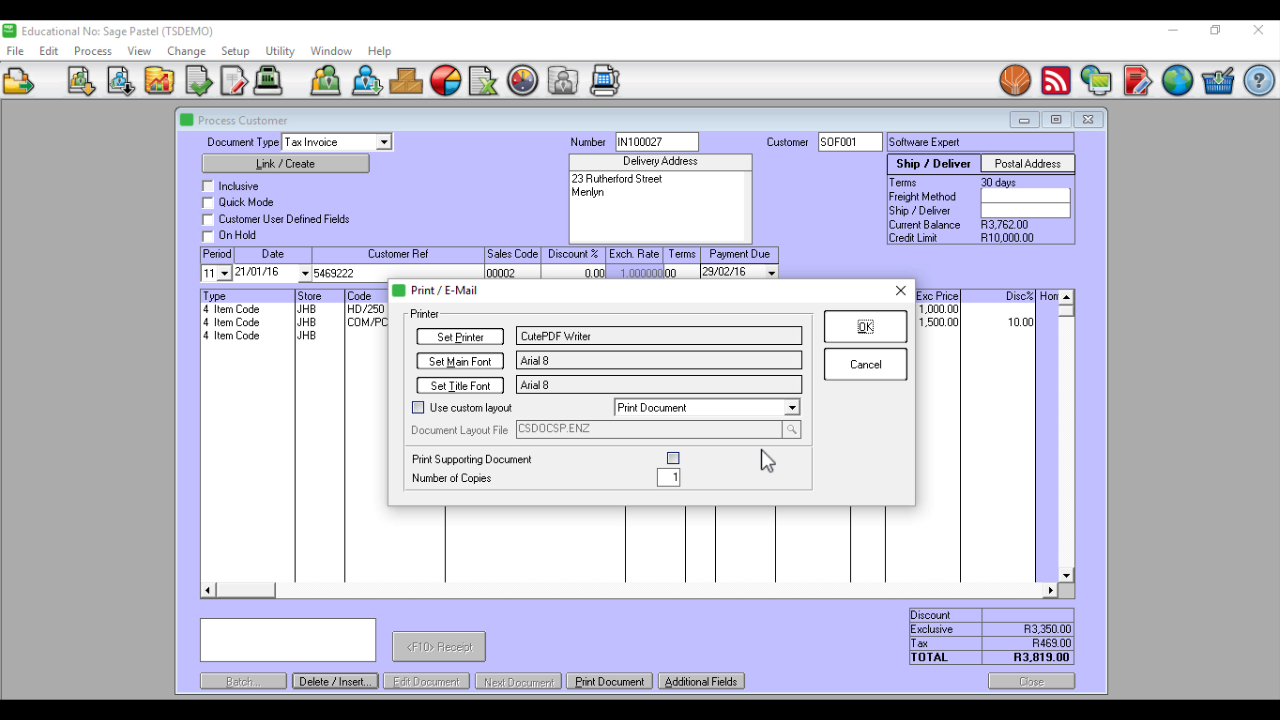

Once you are done adding all the items click on the Next Document button on the lower right.

This will bring up the print window to print the invoice.

For the purposes of this training we will not be printing the invoice so you can click on Cancel.

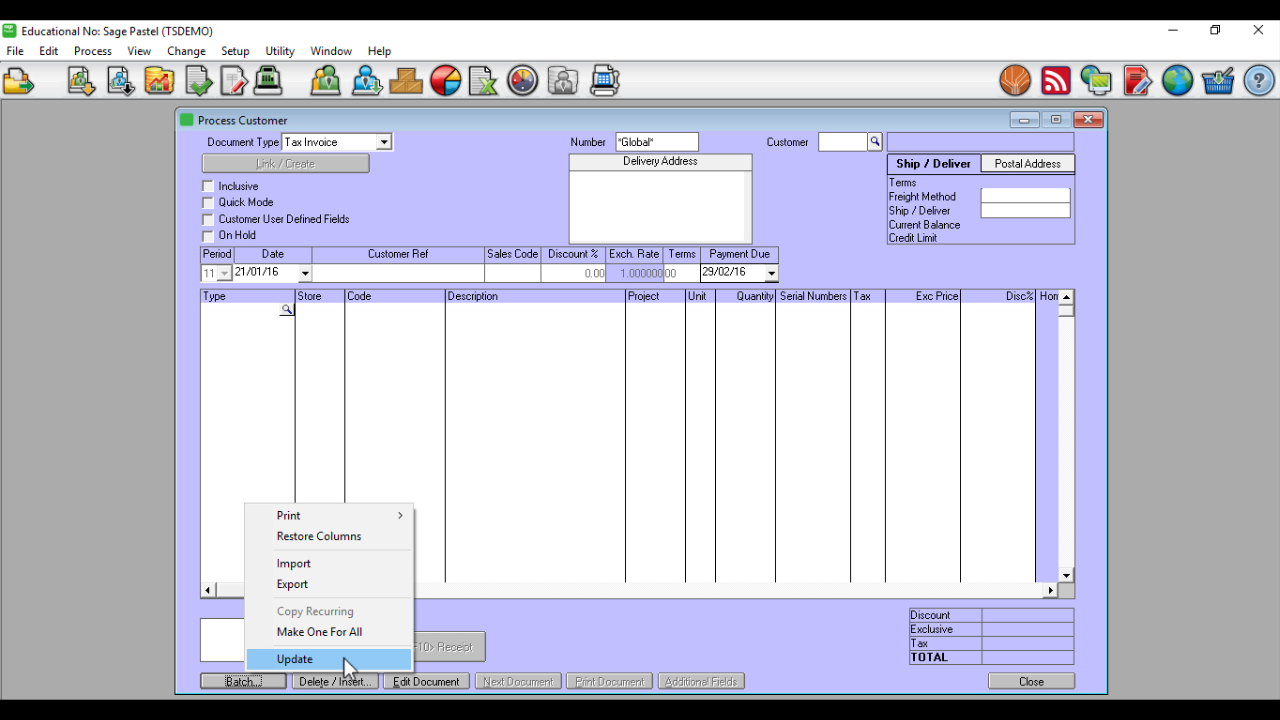

Remember, that the invoice you just completed (together with other invoices) will sit in the batch until the batch is updated.

Only once the batch is updated will the General Ledger be updated.

To update the Batch click on the Batch button and select Update.

That concludes the lesson.

Did you find this lesson useful?

Click here to get more free lessons.

If you require any Pastel Support we can help. Please leave your details on our contact form and we will get back to you.

Get Free Sample Pastel Lessons

See how easy it is to learn Sage Pastel Partner by getting some free sample lessons to start with

Its easy to follow

It is so far easy and understanding

Thank you so much

So far it’s easy, I hope that doesn’t change.

Excellent – explanation of course is very thorough.

Thank you

was a great lesson thanks so much

Thank you for the lesson and looking forward for more

Excellent

Thank you so much I am looking forward to doing the course itself.

It looks easy, i can’t wait to do the course

Wow! you made it simple and easy for me. thank you

Thank you the video was excellent, clear and easy to follow. No questions as yet.

Barbara Rosenstein.

Awesome video !!! I understood everything !! ????

Wonderfully easy to navigate

What I see from the demo video is that the G/L is only updated after the Batch has been posted.

So only after this the stock levels are updated?

What if we have 4 hard drives in stock at the start of day and we keep the batch open until end of day, but in the mean time we invoice 5 HD’s to 5 different customers?

Will this be allowed or will we be warned that we are out of stock?

Issue 2: Why must we enter the retail/Selling price?

Should it not be automatically be picked up from the Inventory/Stock file?

Will definitely join looks like fun and not hard at all

Thank you very easy to follow and helpful!

The system is user friendly…

This is nice

hi, It is useful to me.

Please help me on how to reverse the tax invoice

Kind regars,

Mashala,J

wow it was soo nice and well explained

Debtors clerk video and training on pastel please

Excellent.

Can’t wait to start my course.

Good day

i was wondering how to change the template of an invoice. Please advise.

Thank You for the lesson. Easy to follow and understand.

Hi Guys, what if you are a company that is into services how do invoice a client in pastel partner. NB we do not sell any products so no inventory.

I found it very interresting and will definitely query to go further

Hi

After i did my invoices and a printed and updated or batch, is it possible to go back to the invoice and change a date?

this makes life so much easier. thanks so much

The course is not complicated , in everything one must focus on what he is studying for the best feedback thank you for this sample course . Now i have got a clear view of what expecting studying

I have the whole processing of an invoice sorted…what im missing is my company details when I actually print the invoice…how to I ensure my company details are included on the invoice I want to issue to a client

hey

i entered wrong figure on the invoice is it possible to reverse or delete the transaction?

Did I do something wrong,in my invoice the quantity column is blocked out and I can not add a quantity,your help herein would be greatly appreciated

Easy to follow and understand. Lesson well presented.

Thank you so much

Definitely easy to follow

Wow looks so easy indeed.

Grrrrrrrrrrreat stuff so easy to learn and understand. Its like spoonfeading a baby.totally excited Great work guyz. I feel like doing this course.

Wow it was very easy to follow

Thanks it was easy to understand

thanks so much for the training it was so easy to follow.

The demo was very easy to follow and well presented. Very nice.

The training was very easy to follow, thanks

It was really easy to follow.

Thanks it was easy to understand.

Thank you. That was really easy to understand.

I am a bit confused with this statement. “IMPORTANT: If you want to save each line that you enter you must tab to a new line. If you don’t tab to a new line then the line will not be saved and processed.”

It only saves if you tab to a new line, however it then states that if you don’t tab to a new line, it won’t be saved but processed?

Can you explain this in a bit more detail?

Great stuff! Easy to follow. Thanks.

Wow looks so easy. Wanted to know if Sage Pastel is being used mostly in the working environment?

Thanks